Sustainable Impact

In pursuing corporate sustainability, Cathay FHC abides by the spirit of "What if We Could," aspiring to leverage our influence in the financial industry and drive positive change across sectors. This commitment aims to enhance societal well-being while mitigating environmental footprints and human rights risks, thereby creating long-term positive value for stakeholders. Since 2018, Cathay FHC has collaborated with academic institutions to develop the Profits and Losses of Five Major Capitals (5C P&L) assessment framework, which is based on impact valuation methodologies and integrates financial profit and loss (P&L) with Triple Bottom Line (TBL) management concepts. It evaluates the external impacts of value chain activities on the economy, environment, and human rights through a sustainability impact pathway driven by causal relationships, translating these impacts into monetized social benefits (positive) and costs (negative).

Milestones

Corporate Sustainability Principles and Corporate

Governance Best Practice Principles

Cathay Financial Holdings Sustainability Governance Framework

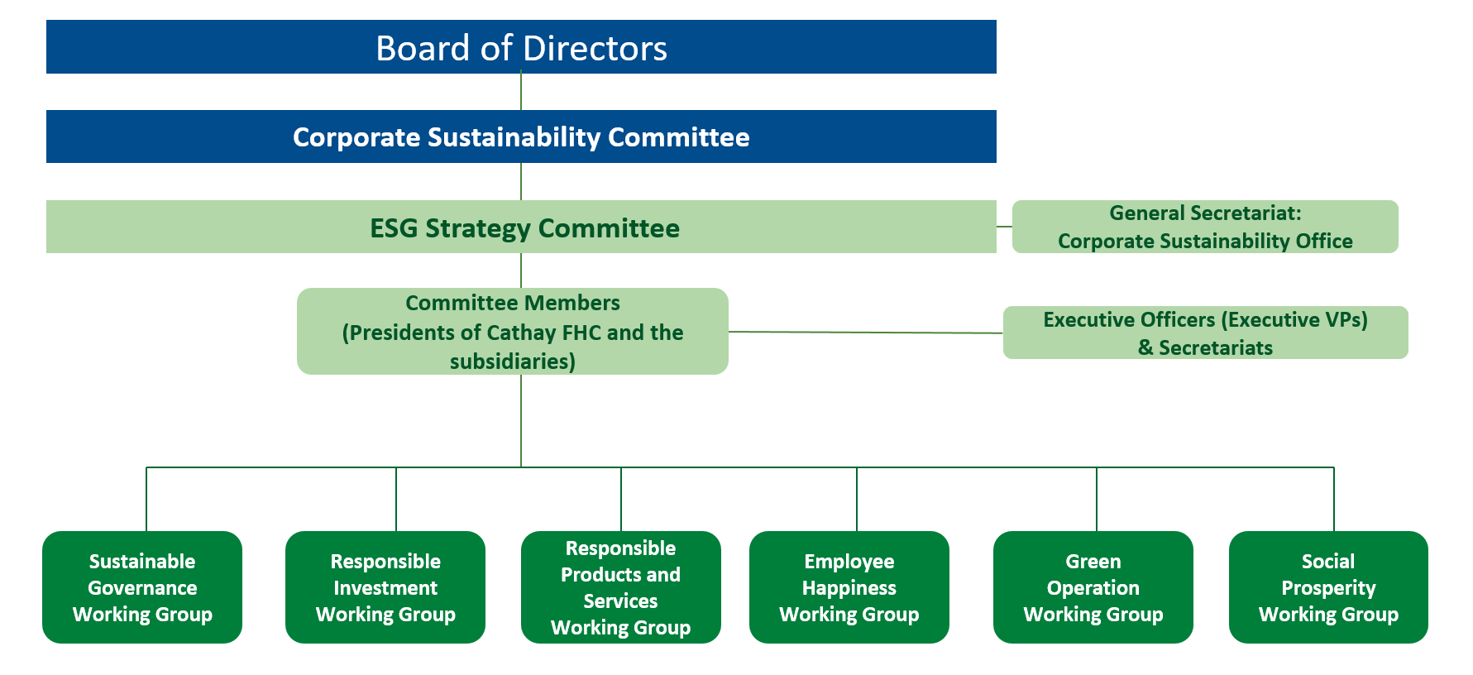

The company has established a Corporate Sustainability Office under the president’s supervision, dedicated to promoting sustainability within the group. The office identifies stakeholders relevant to the company's operations, assesses their sustainability concerns, and evaluates the impact and risks of these issues on the company’s core business. Using the principle of materiality, an annual analysis of material issues is conducted, based on which short-, medium-, and long-term goals are set.

The company leverages its core financial and risk management functions to focus on 10 Sustainable Development Goals (SDGs). It has formulated the Cathay Sustainability Strategy under three pillars—Climate, Health, and Empowerment—along with strategic objectives, action plans, and effectiveness reviews. The Corporate Sustainability Office also acts as the secretariat of the Corporate Sustainability Committee, reporting resolutions, progress on sustainability strategies, implementation of major projects, and achievement of sustainability goals to the BoD every six months.

In 2024, reports to the Board included updates on sustainability policy reviews and revisions, stakeholder engagement and communication outcomes, progress on the three sustainability strategy pillars, advancement in the Science-Based Targets initiative (SBTi), the zero-carbon operations transformation plan, and the implementation of sustainability-related tasks.

To enhance corporate sustainability governance and improve the effectiveness of the BoD, the company established a Corporate Sustainability Committee as a functional committee on January 1, 2025. This committee consists of at least three directors appointed by the Board, including at least one independent director. At least one member must possess relevant management capabilities or experience. Following the establishment of the functional committee, the existing Corporate Sustainability Committee will continue to convene under its supervision and be renamed the ESG Strategy Committee.

To strengthen the Group's ESG governance framework, Cathay FHC established the position of Chief Sustainability Officer (CSO) in August 2025. The role is concurrently assumed by Mr. Chang-Ken Lee, President of Cathay FHC, who also serves as a member of the Corporate Sustainability Committee and Chair of the ESG Strategy Committee. The CSO is responsible for formulating the Group's sustainability strategy and goals, and overseeing the implementation of sustainability initiatives.

The BoD regularly monitors the progress of sustainability initiatives, with independent directors involved in supervision to support adjustments and improvements by the Management. To ensure the Board and functional committees fulfill their responsibilities in governance, the company has established Regulations Governing the Evaluation of the Board and Functional Committee’s Performance. The evaluation incorporates sustainability indicators such as compliance, corporate governance, risk management, and corporate sustainability and social responsibility. In 2023, the internal performance evaluation of the company’s Board of Directors and functional committees resulted in a rating of “Exceeds Expectations.”