Strengthen the group's climate-related financial disclosure

In 2022, Cathay FHC published its first TCFD Report. The TCFD section in its Sustainability Report was also listed in the TCFD Status Reports as an outstanding case study in risk management, a first in Taiwan's financial sector.

Engaging Biodiversity Initiatives

Cathay United Bank became the Equator Principles signatory in Taiwan in 2015, integrating biodiversity indicators into project finance management. Cathay Financial Holdings participated The Taskforce on Nature-related Financial Disclosures (TNFD) in August 2022. We also became the first Taiwan financial institution to join Partnership for Biodiversity Accounting Financials (PBAF) in September 2022. In 2023, Cathay FHC officially joined the Business for Nature COP15 Business Advocacy Campaign, Cathay Life joined Nature Action 100 in the same year.

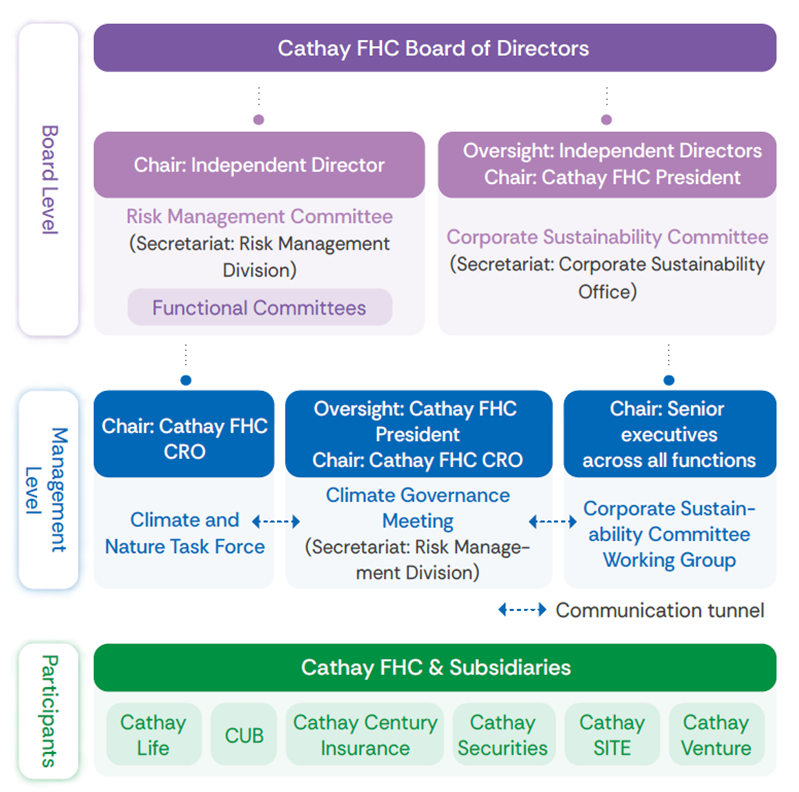

Cathay FHC's Climate Governance Framework

To strengthen board effectiveness and ensure sound sustainability governance, Cathay has established two board-level functional committees the Corporate Sustainable Development Committee and the Risk Management Committee tasked with reviewing and supervising the implementation and management of ESG and climate-related policies, systems, strategies, and plans. In addition, quarterly Climate Governance Meetings are convened for senior executives to discuss and build consensus on key climate and nature-related issues, thereby enhancing our responsiveness and resilience.

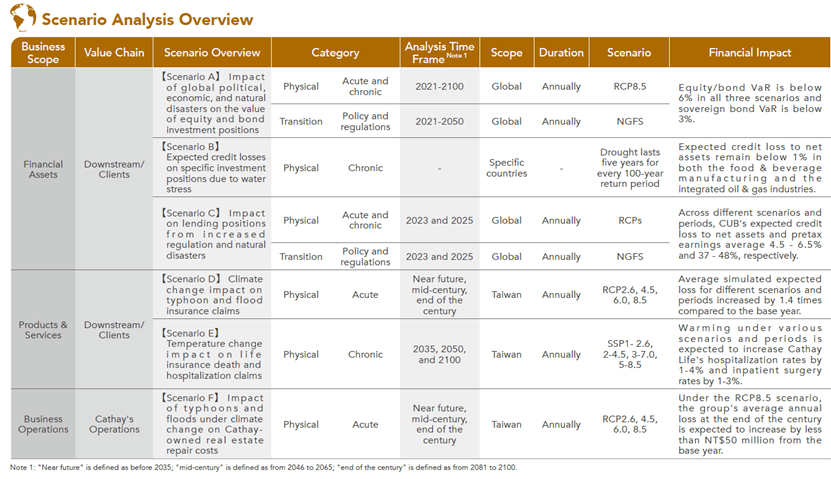

Climate and Nature Scenario Analysis

To better understand the financial impacts of climate change, Cathay FHC has conducted quantitative financial scenario analyses across its core businesses and value chain. These analyses aim to validate the resilience of its strategies and formulate appropriate mitigating actions. Currently, Cathay FHC adopts internationally recognized climate scenarios, including those from the

Intergovernmental Panel on Climate Change (IPCC), the International Energy Agency (IEA), and the Network of Central Banks and Supervisors for Greening the Financial System (NGFS). The analysis also incorporates each country's Nationally Determined Contributions (NDCs) to ensure a comprehensive assessment of climate-related risks to the financial system.

Intergovernmental Panel on Climate Change (IPCC), the International Energy Agency (IEA), and the Network of Central Banks and Supervisors for Greening the Financial System (NGFS). The analysis also incorporates each country's Nationally Determined Contributions (NDCs) to ensure a comprehensive assessment of climate-related risks to the financial system.