Cathay believes pursuing corporate sustainability contributes social stability which can bring virtuous cycles in the society and also improves the companies’ long-term value. Corporate sustainability development requires systematic actions, therefore we incorporate sustainability into Cathay’s core competencies in accordance with the international sustainability framework and promote sustainable finance. Especially as the largest financial institution in Taiwan with total assets more than NT$ 12 trillion, serving half of Taiwanese population, Cathay has the responsibility to lead the industry towards sustainability.

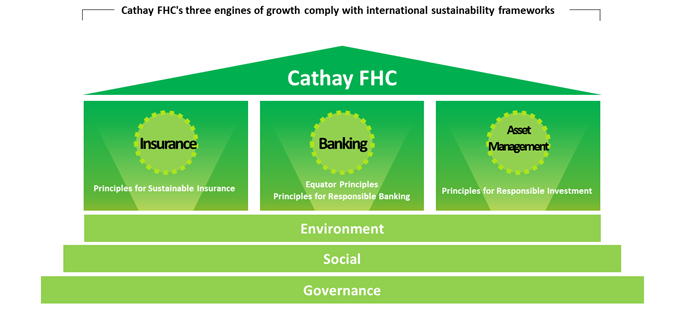

Cathay's Sustainability Framework

Sustainable development is inseparable from a company's core competencies. Hence, Cathay's three engines of growth correspond to international sustainability frameworks: the PSI, EP, PRB and PRI, while ESG is incorporated into our core operations. Cathay strengthens its core competitiveness through emphasis on sustainability and grasp on trends, opportunities and risks. This creates an all-winning situation for company profitability, mutual prosperity with society, and environmental sustainability.

(1) Principles for Sustainable Insurance (PSI)

Principle for Sustainable Insurance (PSI) is an international framework launched by UN. It require insurance companies to integrate ESG into business. Cathay Life became Asia's first life insurance company self-complying with the Principles for Sustainable Insurance (PSI) in 2016. Cathay Life completed the CS Strategic Blue Print in 2018 to enhance the implementation of sustainable strategies. We also have been adopting strategic focuses, CARE (Commitment, Accountability, Richness, Eco-living), to set short/medium/long-term goals and continuously monitor the progress. Cathay Century Insurance also self-complies PSI in 2017.

Cathay Life has incorporated ESG into our operations in accordance with PSI and its CARE strategy. We actively engage with stakeholders through a variety of channels and publishes PSI annual self-compliance reports to disclose PSI achievements and our sustainable actions. Cathay Century also integrate ESG into core business and published PSI Disclosure Report and Sustainability Report every year.

(2) Equator principles (EPs)

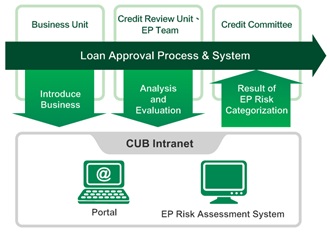

The “Equator Principles” (EPs) is an international risk management framework for financial industry. It categorises risks in large project finance based on their potential environmental and social impact and initiates varying levels of review for different categories. It requires lenders to include human rights and engagement mechanisms, establish an environmental and social management system, and establish action plans in accordance with risks disclosed in environmental assessments. These items are listed in credit contracts for compliance and execution. Banks shall implement continuous monitoring of project construction and operations after funding loans and regularly disclose information on the implementation status.

CUB also issues ESG guidelines for corporate lending “Principles Governing Corporate Loans by Environmental, Social, and Governance (ESG) Criteria” in 2017 to extend scope for "responsible lending" to all corporate borrowers. CUB integrates ESG risk management and corporate governance into the credit lending procedures to achieve the objectives of business growth and sustainable development.

|

|

|

Cathay United Bank's dedicated units

|

Corporate loan application & review process

|

(3) Principles for Responsible Banking (PRB)

Cathay United Bank declared its voluntary compliance with the United Nations' Principles for Responsible Banking (PRB) at the end of 2018 to line up with international sustainability frameworks and set an example for the industry. CUB became the first bank in Taiwan to obtain PRB compliance assurance from a CPA firm in February 2021, and takes concrete actions to fulfill the corporate social responsibility of a financial institution. CUB continues to promote the PRB and maximize financial influence based on its banking core competencies to facilitate the prosperity of companies, society, and the environment.

Material influence target 1: Renewable energy loans

Targets for renewable energy loans established by Cathay United Bank: "Continue to increase the percentage of renewable energy in the Bank's electricity supply lending and reach 85% by 2025." CUB will take concrete actions to promote the growth of the green finance industry in Taiwan and support renewable energy development. As of the end of 2021, renewable energy accounted for 77.53% of the Bank's electricity supply lending, up 1.45% compared with 76.08% at the end of 2020.

Material influence target 2: Reduce loans for industries with high carbon emissions

Cathay United Bank has suspended new loans for coal-fired power generation projects starting from October 2019 to demonstrate its resolve towards supporting international carbon emissions reduction initiatives and countering climate-related risks. The Bank established the policy of "Zero Coal financing" in 2021, and set the goal to reduce the credit facility for the coal industry chain to zero by the end of the first quarter of 2027.

CUB Progress Report on the Implementation of the PRB

(4)Principles for Responsible Investment (PRI)

Principles for Responsible Investment (PRI) is an international framework launched by UN, requiring investors to integrate ESG into investing process. Cathay believes institutional investors have responsibility to exercise its positive influence to investee companies. Cathay was the first Taiwanese financial institution establishing the Responsible Investment Working Group in 2014. The Working Group is led by the Chief Investment Officer of the Cathay FHC and it works together with senior investment executives of subsidiaries. Cathay Life and Cathay SITE have also respectively established their Responsible Investment Task Force with total of 51 members and 3 dedicated employees. Cathay Life and Cathay SITE have voluntarily adopted PRI in 2015.

Cathay FHC has established a top-down supervisory mechanism as well as a bottom-up analysis & review process for responsible investment and lending to mitigate ESG risks. Cathay aims to strengthen Cathay’s long-term investment/lending value and protect the rights of our clients and shareholders.