Risk Management Measures

We established risk assessment indicators for major risks. All of the indicators were reviewed and approved by the Board of Directors, and are periodically assessed and monitored. Furthermore, we conduct stress tests to assess our capital adequacy given changes in the business environment.

Risk Management Reporting Mechanisms

We established Regulations for Reporting Operational Risk Events, Regulations for Reporting Emergency Credit Risk Events, and Regulations Governing the Handling of Major Incidents to improve our risk management performance, and established corresponding reporting systems. When a risk event occurs, units or subsidiaries shall immediately report it to the Risk Management Division to open a case for management. The units or subsidiaries inspect the progress of risk events and implementation of improvement plans each month, and report progress to the Risk Management Division.

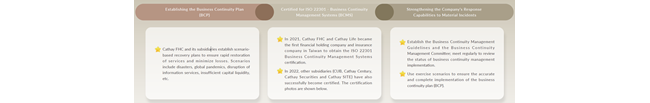

Business Continuity Management

Companies can only increase their operational resilience by strengthening their ability to respond to risks and emergencies in the face of rapid global changes. Cathay FHC and its subsidiaries take the following measures to continuously improve our business continuity management to protect the rights of our customers.