Structure and Operations of the Board of Directors

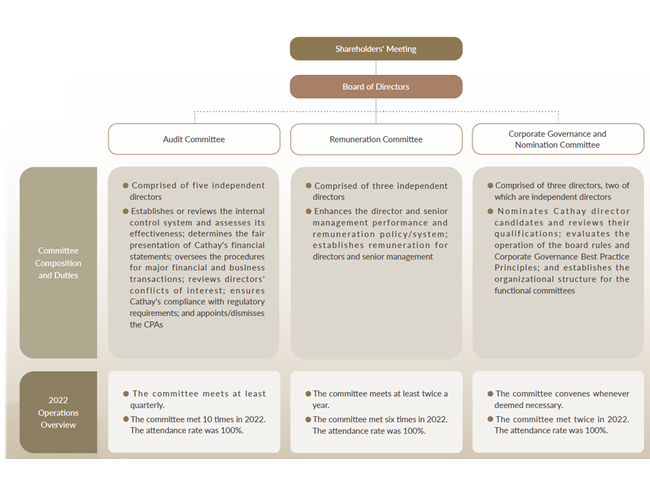

At Cathay FHC, the board of directors serves as the highest decision-making body, with the chairman acting as its head. The chairman's role is to oversee the company's overall management operation and does not hold any senior leadership management positions. In 2022, the board of directors held 12 meetings with a board attendance rate of 92%. On average, board members have served for 10.8 years (five independent directors serve an average of 3.9 years). At Cathay FHC, the board of directors has established three functional committees: the audit committee, remuneration committee, and corporate governance and nomination committee. These committees are responsible for reviewing important proposals. To effectively implement independent supervision and checks and balances, all proposals at Cathay FHC are reported and discussed by the board of directors. If there is a conflict of interest with the director or the institution he/she represents, the director shall recuse him/herself from the proposal discussion to maximize the benefit of all stakeholders.

Professional Qualifications and Independence of the Board

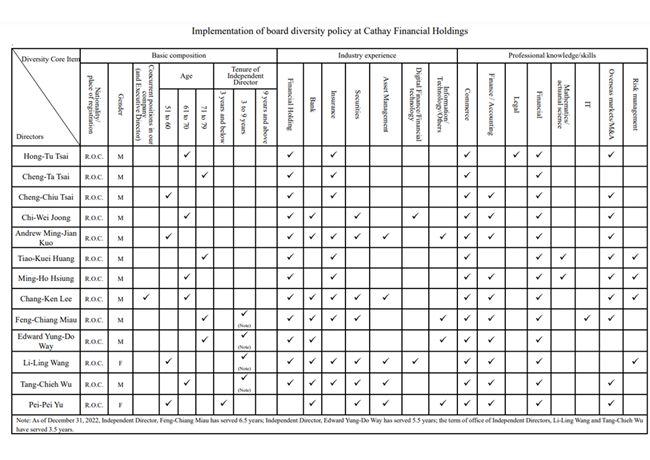

Cathay FHC adopts the candidate nomination system. All director candidates are nominated and their qualifications are reviewed by the Corporate Governance and Nomination Committee. After candidates are approved by the Board of Directors, they are elected and appointed during the shareholders' meeting. According to Paragraph 3, Article 30 of Cathay FHC's Corporate Governance Best Practice Principles, the members of the Board of Directors shall possess the knowledge, skills, and experience necessary for performing their duties. In response to issues concerning corporate governance and corporate sustainability in Taiwan and abroad, the directors of Cathay FHC actively participate in relevant internal and external training, which covers issues including risk management, corporate governance, corporate social responsibility, AML/CFT, and information security. The average training hours for the directors stood at approx. 14 in 2022.

Board Diversity and Effectiveness

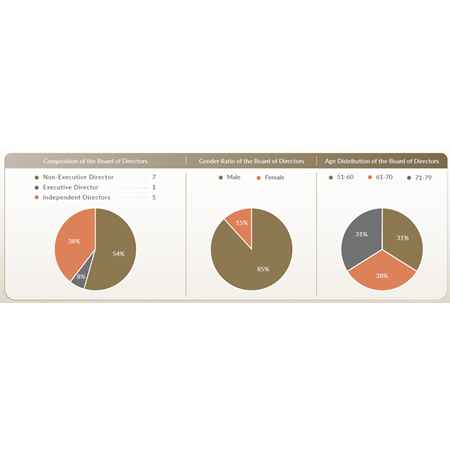

Members of Cathay FHC's Board of Directors come from diverse backgrounds, including different industries, academic backgrounds, and professional knowledge and abilities. The Board has 2 female independent directors to increase Board diversity.

Cathay FHC has established several guidelines and regulations to improve the effectiveness of its board of directors. These include the "Guidelines for Evaluation of Directors' Performance" and "Guidelines for Directors' Remuneration," as well as the "Regulations Governing the Evaluation of the Board and Functional Committee's Performance." These guidelines incorporate indicators such as compliance, corporate governance, risk control, corporate sustainability and corporate social responsibility. At Cathay, we are committed to ensuring that the board and the functional committees fulfill their duties and responsibilities in governance, operations, and corporate sustainability. To this end, we conduct an annual performance evaluation of the board and functional committees. Members of the board and the functional committees, along with the agenda working group, are evaluated for their performances based on established indicators. The agenda working group then organizes the evaluation results, which are filed into three categories - "exceeding expectations," "meeting expectations," and "room for improvement," and presents them to the board of directors

To strengthen the independence and effectiveness of the Board performance evaluation, Cathay FHC will appoint an external independent institution or an expert to carry out the Board performance evaluation once every three years, starting from 2017. Cathay FHC in 2019 and 2022 commissioned the Taiwan Institute of Ethical Business and Forensics to complete an external evaluation of Board performance in 2018 and 2021, respectively, and has devised and implemented improvement measures as advised by the institute. Please see the results of 2022 Cathay FHC's internal and external Board and functional committee performance evaluations.

In order to lower the risks taken on by directors, supervisors, and the Company in general, Cathay FHC has purchased liability insurance since 2007 for its directors, supervisors, and key staff members, including those from its subsidiaries. This is in line with the legal requirements during their terms in office. The contents of the insurance policy are reviewed annually and reported to the Board after the policy is renewed each year.

Remuneration of Senior Management

Manager performance evaluations and the remuneration policy, system, standard, and structure are reviewed by the Remuneration Committee of Cathay FHC, and then submitted to the Board of Directors for resolution. Our goal is for managers to fulfill their duties to improve our long-term business performance, and further achieve our business strategies and ensure shareholders equity. Cathay carries out performance management and pays remuneration in accordance with the Manager Performance Development Guidelines and Guidelines for Remuneration of Senior Management. The performance of managers is evaluated based on annual goal attainment, and results serve as the basis for remuneration. For more information on remuneration of Cathay FHC’s CEO, please refer to 2022 Cathay FHC's Report on Remuneration of the President.